Government Schemes for Business Energy Customers & Finance and Support

Introduction to the Energy Bill Discount Scheme

In today's ever-evolving business landscape, energy consumption and sustainability have become pivotal factors for companies of all sizes. As organisations seek to balance profitability with environmental responsibility, the UK government has introduced a range of initiatives and schemes to provide crucial support to business energy customers. These programs aim to empower businesses to make more informed, cost-effective, and environmentally friendly energy choices, all while navigating the complex terrain of the energy market.

In this comprehensive guide, we delve into the UK government schemes that are currently in place to assist business energy customers. From grants and incentives designed to boost energy efficiency to strategies for managing the rising costs of energy, this guide will illuminate the avenues through which businesses can harness government support to meet their energy needs effectively. Whether you are a small enterprise or a large corporation, understanding and utilising these resources can help you not only navigate the energy landscape but also transform it into a strategic advantage for your business.

The Energy Bill Discount Scheme (EBDS) Explained

Summary:

The Energy Bills Discount Scheme is the government's latest initiative to provide support for businesses grappling with escalating energy costs. It came into effect on April 1, replacing the Energy Bill Relief Scheme, but it's important to note that it isn't a business energy price cap.

Instead, this scheme provides discounted unit rates for fixed-price contracts signed on or after December 1, 2021, as well as for deemed and out-of-contract rates, with a minimum threshold in place.

The Energy Bills Discount Scheme (EBDS) stepped in as a successor to the Energy Bill Relief Scheme (EBRS) on April 1, 2023. This new scheme offers reductions on non-domestic gas and electricity unit rates. The unit rate, measured in kilowatt-hours (kWh), signifies the cost your business incurs for each unit of energy it consumes.

EBDS is accessible to non-domestic clients who have entered into fixed-price agreements starting from December 1, 2021, as well as those on deemed and out-of-contract rates. However, it's important to note that deemed and out-of-contract rates typically come at a premium compared to contracted rates. Hence, it's advisable to explore various options and compare deals to determine if transitioning to a fixed-price contract could result in cost savings.

The Energy Bills Discount Scheme runs for 12 months from 1 April 2023 to 31 March 2024.

The scheme is made up of 3 different parts:

- The baseline discount provides some support with energy bills for eligible non-domestic customers in Great Britain and Northern Ireland – this support is applied automatically

- The Energy and Trade Intensive Industries (ETII) discount provides a higher level of support to businesses and organisations in eligible sectors – you need to apply for this support

- The Heat Network discount provides a higher level of support to heat networks with domestic end consumers – you need to apply for this support

How does the Baseline EBDS discount operate?

Similar to the current scheme, the Energy Bills Discount Scheme (EBDS) provides a discount on the wholesale segment of your unit rates, provided they exceed a minimum threshold. Industries classified as Energy Trade Intensive Industries - those with substantial energy consumption - receive a more significant relative discount than other businesses, with a lower threshold price.

For most business energy users, the discount works as follows:

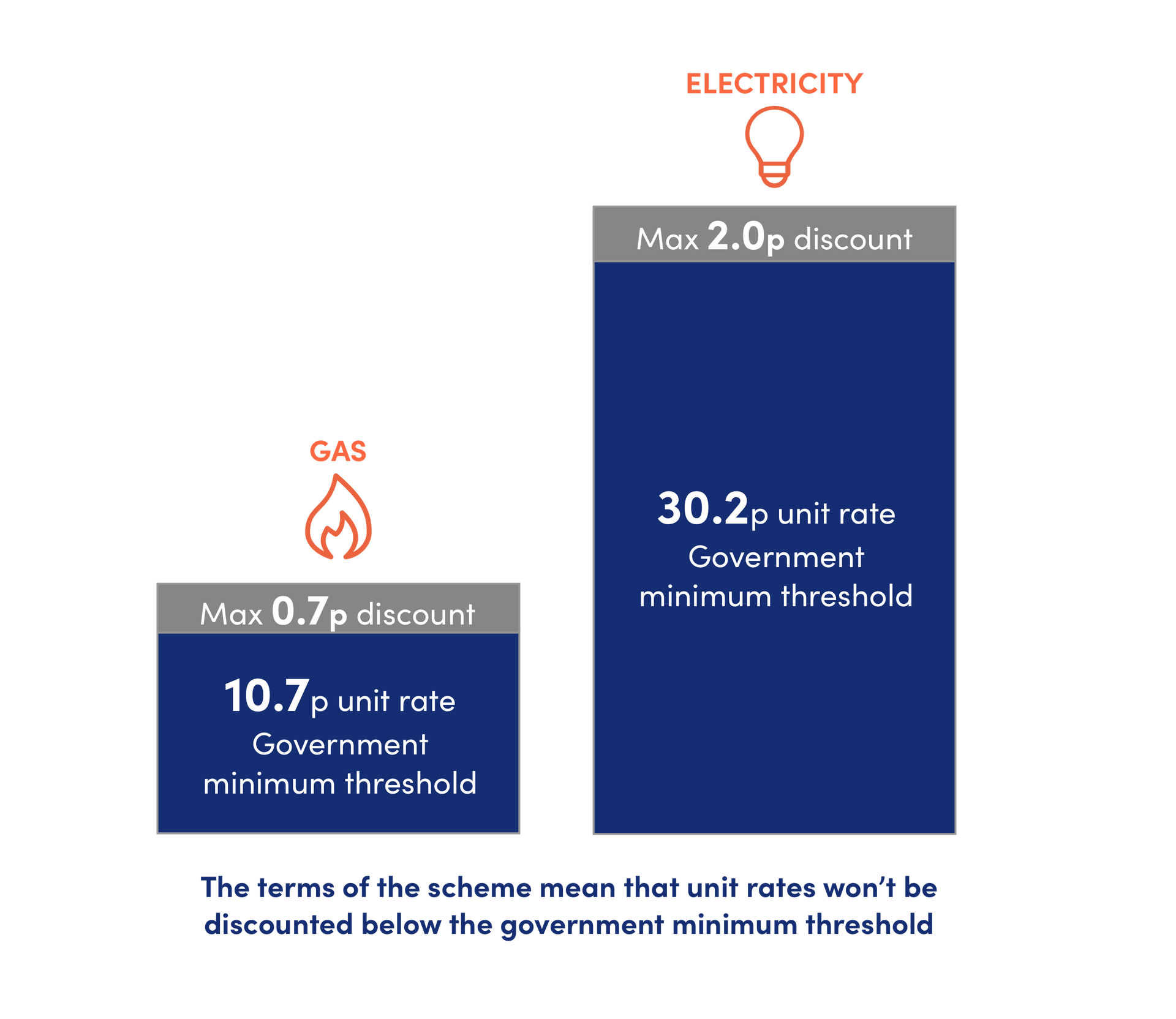

Gas:

Up to a maximum of £0.00697 (approximately 0.7p per kWh) subtracted from the difference between the wholesale component of the unit rate you pay to your business gas supplier and the price threshold of 10.70p per kWh.

Electricity:

A deduction of £0.01961 (about 2.0p per kWh) from the difference between the wholesale element of the unit rate you pay to your business electricity supplier and the price threshold of 30.20p per kWh.

The discount cannot reduce your rates below the minimum threshold of 10.70p per kWh for gas and 30.20p per kWh for electricity. If your business's current rates are equal to or less than these thresholds, it will not qualify for the discount.

But How will this Discount Benefit Your Business?

If your energy contract is eligible, you can expect reduced energy expenses. However, it's essential to note that the government's allocation for this support scheme has experienced a significant reduction when compared to the funding available for the Energy Bill Relief Scheme which ended April 1st 2023.

To provide some perspective, the Energy Bill Relief Scheme received an estimated total funding of approximately £18 billion for the six-month period from October 1, 2022, to March 31, 2023. In contrast, the Energy Bills Discount Scheme is set to receive capped funding of £5.5 billion for the 12-month duration from April 1, 2023, to March 31, 2024.

Consider, for instance, a pub as an illustrative case, using 16 MWh (16,000 kWh) of gas and 4 MWh (4,000 kWh) of electricity each month. Let's assume this pub entered into a fixed contract in January 2023, resulting in a monthly gas bill of £2,976 and a monthly electricity bill of £1,796 (for simplicity, we'll omit the standing charges, as they remain unaffected by the scheme). In this context, the pub would experience monthly savings of £112 on gas and £80 on electricity. This translates to a potential annual saving of £2,304 for both energy sources.

Here's an example of how the EBDS could affect your business gas rates

The fixed unit rate agreed with the gas supplier 18.6p

Government threshold unit rate 10.7p

Difference between the fixed rate and threshold rate (18.6p - 10.7p) 7.9p

Discounted rate 7.2p

The monthly bill before discount £2,976

The monthly bill after discount £2,864

The total saving on the monthly gas bill £112

Here's an example of how the EBDS could affect your business gas rates

The fixed unit rate agreed with the electricity supplier

44.9p

Government threshold unit rate 30.2p

Difference between the fixed rate and threshold rate (44.9p - 30.2p) 14.7p

Discounted unit rate (14.7p - 2.0p) 12.7p

Monthly electricity bill before discount £1,796

Monthly electricity bill after discount £1,716

Total saving on the monthly electricity bill

£80

Similar to the Energy Bill Relief Scheme, you won't qualify for a discount if your existing rates fall below the minimum threshold.

The discount you receive is determined by how much your rates exceed the threshold rates, and it's applicable only when the wholesale component of your unit rate surpasses the government-established threshold rates of 10.7p per kWh for gas and 30.2p per kWh for electricity. Additionally, you may not receive the entire discount if your rate already reaches the maximum for that energy source before the complete discount can be applied.

For instance, if the wholesale portion of your unit rate is 31.2p per kWh, you'll only receive a 1p discount since your rate will have already met the government's threshold unit rate before the full 2p discount can be applied. However, if the wholesale portion of your unit rate is 32.2p per kWh or higher, you'll qualify for the full discount.

How Does the EBDS for Energy and Trade Intensive Industries (ETIIs) Operate?

For Energy Trade Intensive Industries, encompassing major energy consumers such as those in mining and manufacturing sectors (a comprehensive list of qualifying Energy Trade Intensive Industries can be found on the government website), the scheme operates as follows:

Gas:

A reduction of 4.0p is applied to the difference between the wholesale component of the unit rate you pay to your supplier and the price threshold of 9.9p per kWh.

Electricity:

An 8.9p discount is subtracted from the difference between the wholesale segment of the unit rate you pay to your supplier and the price threshold of 18.5p per kWh.

It's important to note that these represent the maximum discount rates and are applicable to only 70% of the energy consumption, meaning you'll pay the standard rates for the remaining 30% of your energy usage.

If your business falls under the listed Energy Trade Intensive Industries, you will need to submit an application for the discount.

Ed Whitworth, Head of Energy Performance at Bionic, remarked, "While the government's new Energy Bill Discount Scheme may not be as generous as the Energy Bill Relief Scheme, it's a positive development for businesses grappling with high energy costs. Although it's accessible to all non-domestic customers, whether on contracted, deemed, or out-of-contract rates, it remains prudent to compare energy quotes and secure your rates. Locking in your rates ensures billing stability in an uncertain market, providing a consistent price for your energy. Furthermore, as with the Energy Bill Relief Scheme, lower contracted rates translate to lower discounted rates."

Who is Eligible for the ETIIs?

An organisation is considered eligible for ETII support if at least 50% of its revenue is generated from UK-based activity within eligible Standard Industrial Classification (SIC) code sectors.

The discount will apply to 70% of energy volumes.

You must have a non-domestic contract with a licensed energy supplier and be:

- on existing fixed price contracts that were agreed on or after 1 December 2021

- signing new fixed price contracts

- on deemed/out of contract or variable tariffs

- on flexible purchase (or similar) contracts

- on variable ‘Day Ahead Index’ (DAI) tariffs (Northern Ireland scheme only)

For local authorities, eligibility may be determined at a premise level. Where there are no relevant financial accounts, the local authority will be required to declare that at least 50% of the space within that premise is taken up by operations within eligible sectors.

You will need to apply for support in the same way as ETIIs with licensed energy providers if:

- you’re an ETII that uses energy from a license exempt energy provider

- you’re part of the Non-Standard Cases scheme

You should apply even if energy prices are currently lower than the threshold to receive the discount. Businesses can check your eligibility

here.

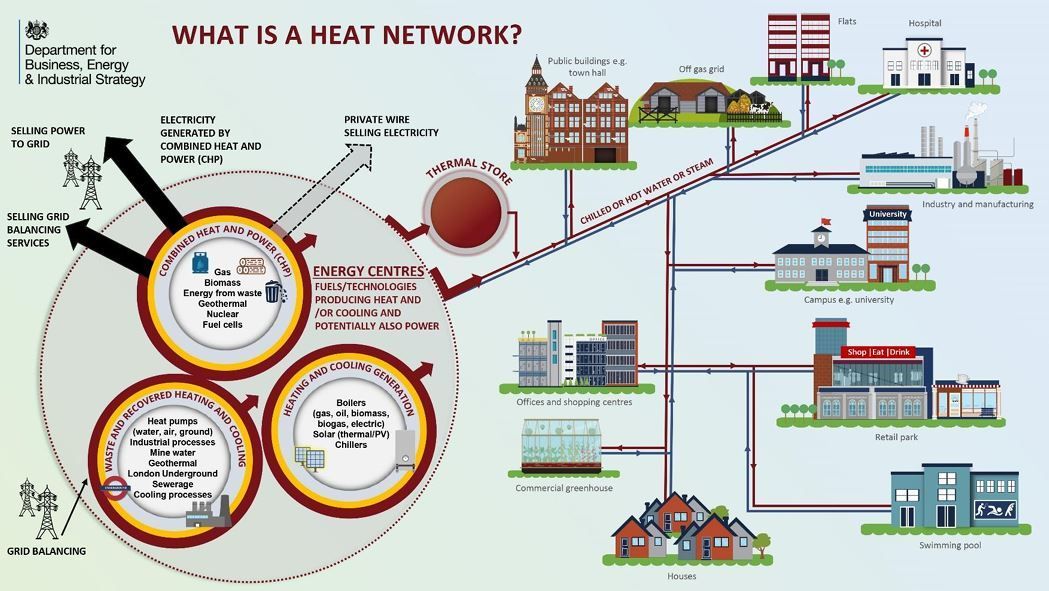

How Does the Heat Network Discount Operate & What is Heat Network?

Heat networks (also known as district heating) supply heat from a central source to consumers, via a network of underground pipes carrying hot water. Heat networks can cover a large area or even an entire city, or be fairly local supplying a small cluster of buildings.

This avoids the need for individual boilers or electric heaters in every building. Heat networks are sometimes described as “central heating for cities”. The central heat source is often referred to as ‘the energy centre’. There are many possible technologies that can provide the input to a heat network including;

- power stations

- energy from waste (EfW) facilities

- industrial processes

- biomass and biogas fuelled boilers and

- Combined Heat and Power (CHP) plants, gas-fired CHP units, fuel cells, heat pumps, geothermal sources, electric boilers and solar thermal arrays

Heat is brought into each building through a ‘heat exchanger’ which, for a residential connection, is about the same size as a small gas boiler. All the same heating controls are available and to the end user the central heating and hot water system works in the same way as a domestic gas-fired central heating system without the need for any combustion to take place inside the building. Heat networks can be various sizes and serve various combinations of building types. Heat networks can be extended over time, and new heat demands and heat sources can be added to the network.

How the Heat Network Scheme Operates

Heat networks usually purchase energy (gas or electricity) to produce heat through business/commercial contracts. This heat is then supplied to customers on heat networks. This means that domestic heat network customers will receive support from the Energy Bill Relief Scheme (EBRS) (for energy use between 1 October 2022 – 31 March 2023) and the Energy Bills Discount Scheme (EBDS) (for energy use between 1 April 2023 – 31 March 2024).

The EBDS aims to ensure that domestic customers on heat networks do not face disproportionately higher heat and hot water bills when compared to customers in equivalent households who are supported by the Energy Price Guarantee (EPG). The scheme will support the wholesale element of a heat network’s energy tariff, up to the point that the Minimum Supply Price is achieved. The Minimum Supply Prices will be set as:

Electricity: £340 per MWh

Gas: £78.30 per MWh

The government brought into force the Energy Bills Discount Scheme Regulations 2023 (GB), the Energy Bills Discount Scheme Regulations 2023 (NI) and the Energy Bills Discount Scheme Pass-through Requirement (Heat Suppliers) Regulations 2023 (GB and NI) on 26 April 2023. These Regulations introduced the following requirements on eligible heat suppliers that have heat networks with at least one domestic end user:

- to apply for a specific higher heat network EBDS discount rate if they receive a discount under EBDS

- to pass on the benefit of the higher heat network EBDS discount rate to end consumers

- to provide consumers with information on how the ‘pass-through’ will be effected

The heat supplier is the body responsible for supplying and charging for the supply of heating and/or hot water to premises supplied by the heat network. In most cases, this will be the body that holds a heat supply contract or equivalent with the consumer.

The following examples will help illustrate who the heat supplier is:

- A housing association has a heat supply contract with its residents, stating that it is responsible for the supply of heat. The housing association contracts out the metering and billing services to a billing agent. The housing association is still classed as the heat supplier under these Regulations as it has a contract to supply heat network customers with heating and hot water.

- A landlord charges its residents for the supply of heat via a service charge. The landlord enters into a contract with an energy service company (or management company), for the purchase of energy and to calculate the heat billing on the service charge. The landlord is still classed as the heat supplier under these Regulations as it holds the contract with the heat network customers to supply heating and hot water, via the leasehold and tenancy agreement which also holds details of the service charge arrangements.

Under the Energy Bills Discount Scheme the heat supplier is responsible for:

- Submitting an application for the higher heat network EBDS rate through the EBDS application portal

- Meeting requirements to pass on the benefit of the EBDS to end users for energy used between 1 April 2023 to 31 March 2024

- Registering for the Energy Ombudsman’s redress scheme should a complaint be made by a consumer

Heat Supplier Eligibility Explained:

Heat suppliers will be eligible for the higher level of support if their heat network:

- Meets the definition of a heat network as defined in the EBDS Regulations

- Is supplied gas or electricity by a licensed supplier for the purposes of generating heat (this criterion can also be met where there is a “chain” of energy supply – for example, where a heat supplier served by a licensed energy supplier provides bulk heat to a residential building landlord who in turn acts as the heat supplier to residents)

- Serves one or more domestic end consumers

Where these eligibility criteria are met, the heat supplier must comply with the application requirement.

Guidance For Heat Suppliers to Apply for the Discount:

All eligible heat suppliers with at least one domestic customer must apply for a specific higher heat network EBDS rate. This applies even if a heat supplier has secured prices cheaper than the EBDS supported variable fuel cost.

Heat suppliers will have until 25 July 2023, 90 days from the scheme introduction date (26 April) to apply for the higher support. If a heat network they supply becomes eligible after the scheme opening date they will have 90 days to apply from the date at which that heat network becomes eligible (or, if later, from the date on which they became aware of its eligibility).

Eligible heat suppliers that have already submitted notifications to OPSS under the Heat Network (Metering and Billing) Regulations 2014 are still required to register for the Energy Bills Discount Scheme Heat Network Support. Doing this will pause the requirement to submit the more comprehensive notification under the Heat Network (Metering and Billing) Regulations 2014 until 25 July 2023. From 25 July 2023, the requirement to notify will apply again.

The Department for Energy Security and Net Zero (DESNZ) has built a digital system to manage the application process. The system is used for:

- applicants to check their eligibility

- applicants to apply

- applicants to upload documentation needed for evidence

Once the applicant has successfully submitted an application it will be reviewed and a decision will be made on eligibility for the scheme. Once a decision has been made DESNZ will inform the applicant of their eligibility status via email.

If the information you provide as part of your application does not satisfy the initial checks, you will be required to submit further evidence. If you are unable to provide sufficient evidence of eligibility your application will not be accepted and you will be notified of this outcome.

Note that applicant information may be shared between organisations.

Please refer to this detailed Government Guidance for Heat Network Suppliers which includes the obligations of Heat Network

Suppliers.

Finance and Support

Across the UK

These support schemes and networks are available across the UK:

- BEIS Industrial Energy Efficiency Accelerator provides funds for companies willing to implement low carbon technology

- Business rates relief – some businesses in England are eligible for a reduction in their business rates bill. This is called ‘business rates relief’. The rules for business rates relief are different if your property is in Scotland, your property is in Wales or your property is in Northern Ireland.

- Capital allowances – businesses who are eligible can fully expense their plant and machinery costs and access 50% first-year allowances for special rate expenditure from April 2023 until 31 March 2026

- Clean Growth Fund invests in early stage UK companies seeking investment capital for low carbon activities

- Energy Bills Discount Scheme runs for 12 months from 1 April 2023 to 31 March 2024. The baseline discount provides some support with energy bills for eligible non-domestic customers and is applied automatically. The Energy and Trade Intensive Industries (ETII) discount provides a higher level of support to businesses and organisations in eligible sectors – you need to apply for this support. Eligible organisations will have 90 days from 26 April 2023 to apply for the higher support. New organisations or newly eligible organisations will have 90 days to apply from the date at which they become eligible.

- Energy Saving Trust’s ‘Transport for funding for businesses and local authorities’ for information on low carbon transport grants and loans available in the UK and Scotland

- Gigabit vouchers give up to £1,500 for homes and £3,500 for businesses to install high speed internet in rural areas

- Green Economy allows SMEs to buy and sell low carbon products and services to other businesses

- Green Skills Bootcamps are part of the Government’s Lifetime Skills Guarantee. They are designed to provide industry relevant training and sector-based skills for eligible individuals or those who are self-employed. Employers can use the list of Skills Bootcamps training providers to find local colleges and providers to work with.

- Industrial Energy Transformation Fund gives matching funds to businesses with high energy use from industrial processes matching funds – up to £30M for feasibility studies, efficiency measures and decarbonisation deployment. Phase 1 and 2 are completed, and IETF Phase 3 is planned for launch in early 2024. For queries about the IETF for England, Wales and Northern Ireland, contact IETF@beis.gov.uk. For queries about the Scottish Industrial Energy Transformation Fund (SIETF), contact IETF@gov.scot

- VAT will no longer be charged from 2022 to 2027 on some domestic energy saving measures in England, Scotland and Wales. Eligible measures include insulation, heat pumps, solar panels, wind turbines and more. In Northern Ireland, the list of qualifying goods and rate of VAT due on installations will remain unchanged. The Northern Ireland Executive will receive a Barnett share of the value of the relief until it can be introduced UK-wide.

- Workplace Charging Scheme gives businesses up to £350 per socket (up to a total of 40) to install electric vehicle chargepoints

- Wrap supports a voluntary agreement on food waste – the Courtauld Commitment 2030 – which enables collaborative action across the entire UK food chain to deliver farm-to-fork reductions in food waste, greenhouse gas (GHG) emissions and water stress that will help the UK food and drink sector achieve global environmental goals

You can also search GOV.UK’s list of active funds that help businesses become greener, or the UK Research and Innovation’s list of business competitions that award grants for green projects.

You can go to the Federation of Small Businesses or your local chamber for advice.

England

These support schemes and networks are available in England:

- Boiler Upgrade Scheme gives up to £6,000 for small businesses to install a heat pump or biomass boiler

- Environmental Land Management GOV.UK schemes provide funds for sustainable farming practices and land recovery

- Local Enterprise Partnership (LEP) growth hubs provide advice on funding, growth and sustainability in 38 regions across England

Northern Ireland

These support schemes and networks are available in Northern Ireland:

Invest Northern Ireland offers advice on how to operate more efficiently. Support includes:

- consultancy for energy and waste management strategies and recommendations

- resource matching service to manage waste and reduce costs

- investment funding for energy saving equipment

Scotland

These support schemes and networks are available in Scotland:

- Business Energy Scotland gives SMEs access to consulting, loans (up to £100,000) and grants (up to £20,000) for energy efficiency and renewable heat measures

- Circular Economy Investment Fund gives SMEs and non-profit organisations matching funds to reduce waste and develop green products

- Domestic charge point funding gives up to £700 toward the installation of an electric vehicle charge point

- eBike loans offer interest-free loans of up to £6,000 for the purchase of an approved electric bike – the repayment period is 4 years

- Electric vehicle (EV) loans gives interest-free loans up to £28,000 to buy a new EV or £10,000 for a motorcycle or scooter – the repayment period is 6 years

- Energy Investment Fund offers loans and investments for commercial and community-based low carbon energy projects

- Find Business Support gives customers an overview of all funding and services offered by public sector organisations across Scotland

- Highland Council Shared Prosperity funding supports these initiatives for SMEs as part of their strategic plan:

- start-up rate, SME growth and sustainability

- business development funding & support

- specialist support for businesses

- Home Energy Scotland offers interest free loans and cashback for energy efficiency and renewable upgrades to a domestic property – maximum loan amount is £32,500 and cashback is £14,000. From Tuesday 27 June 2023, funding for solar PV and energy storage systems will only be available as part of a package together with a heat pump or high heat retention storage heaters. As a result, applications for solar PV and/or energy storage systems only will no longer be eligible.

- NESTRANS Sustainable Travel Scheme gives SMEs and community organizations up to £10,000 in matching funds for sustainable transport initiatives – must be based in Aberdeen or Aberdeenshire

- Private Rented Sector Landlord Loans lets property management businesses borrow up to £15,000 for energy efficiency and £17,000 for renewable systems – interest and fees apply

- Small Business Bonus Scheme provides rates relief to help owners of non-domestic properties, including businesses

- SME Loan Scheme offers interest-free loans from £1,000 to £100,000 to pay for energy efficiency and carbon reducing upgrades – up to £20,000 can be provided as a grant if installing eligible equipment

- Used Electric Vehicle Loan for Business gives interest-free loans up to £20,000 for businesses of all sizes to buy a used electric car, van or moped

- Vehicle retrofits and safe disposal of non-compliant vehicles funds are available from Energy Saving Trust – must be a SME with 9 employees or less and located within 20km of Glasgow, Edinburgh, Aberdeen or Dundee

- Zero Waste Scotland also offers free support and advice for businesses, including a free energy assessment and comprehensive report with actions you can take to reduce emissions

Wales

These support schemes and networks are available in Wales:

- Boiler Upgrade Scheme gives up to £6,000 for small businesses to install a heat pump or biomass boiler

- Business Wales is a government-funded organisation that offers specialist sustainability support in regional centres

- Caerphilly Enterprise Fund gives up to £2,000 in matching funds to SMEs for property improvements, website costs and more – must be located in Caerphilly County

- Media Cymru Greening the Screen Fund – UK registered SMEs in the film and HETV sectors and suppliers of energy, fuel, transport, production assets, information creation and dissemination can apply for a grant funding request between £75,000 and £250,000 for a 12-24 month project. The funding is to scale-up products, services or processes that will reduce the carbon footprint of the screen industry in the Cardiff Capital Region. Competition is live from 18 September – 1 November 2023.

- The Green Business Loan Scheme is delivered through the Development Bank of Wales. It offers incentivised funding packages to support to businesses in Wales looking to invest in going green. There is also consultancy support offered through Business Wales.

- Carmarthenshire Business Growth & Recovery Grant is funded by the UK Government via the Shared Prosperity Fund. The aim of the grant intervention is to strengthen local entrepreneurial ecosystems and supporting businesses at all stages of their development to start, sustain, grow, and innovate, including through local networks. Grants available between £1000 and £10,000. Grants of up to £50,000 can be considered on a case by case basis for applications which clearly demonstrate innovation, Research and Development and/or future proofing projects linked to the local innovation strategy

Regional support in England

East of England

These support schemes and networks are available in the East of England:

- Business Energy Efficiency gives enterprise SMEs up to £10,000 in matching funds for energy efficiency improvements, electric vehicles and new machinery – must be located in Suffolk or Norfolk counties

- The Suffolk Business Grant Scheme is funded by the UK Shared Prosperity Fund. This is delivered by Babergh District Council, East Suffolk Council, Ipswich Borough Council, Mid Suffolk District Council and West Suffolk Council. These district councils are looking to provide support to local SME businesses with grants between £5,000 and £10,000, with a maximum grant intervention of 50%. Businesses wishing to apply or for further guidance and support can contact the New Anglia Growth Hub to discuss their project or call: 0300 333 6536.

- West Suffolk grants through the Growth Hub – grants of between £5,000 to £10,000 are being made available to SMEs in West Suffolk through the Growth Hub. The grants, which require businesses to match fund what they are applying for, are available on a first come first served basis and can be used to support businesses in their development, such as through marketing, web design or the purchase of new equipment. They are funded by West Suffolk Council, using part of the money it was allocated from Government under the UK Shared Prosperity Fund (UKSPF) and Rural England Prosperity Fund (REPF). SMEs can contact the New Anglia Growth Hub at www.newangliagrowthhub.co.uk/contact-us or by phoning 0300 333 6536.

East Midlands

These support schemes and networks are available in East Midlands:

- Green Entrepreneurs Programme has a small grants from £10,000 to £20,000 and a large grant that starts at £100,000 – must be located in Derbyshire County

- Grants4Growth for the South and East Lincolnshire Councils Partnership area, consisting of the 3 districts of Boston, East Lindsey and South Holland, has secured over £2m of UKSPF funding to deliver practical business support to local companies. The Grants4Growth project, launched in early July 2023, will support local businesses to invest in their future awarding both capital and revenue grants to Small & Medium Sized Enterprises (SMEs) looking to grow.

- University of Derby’s Invest to Grow programme gives grants and loans from £15,000 to £250,000 to B2B companies in the East Midlands that create jobs in different sectors, including low carbon

- Workplace Travel Service Grants give SMEs up to £25,000 for travel improvements such as electric vehicle chargers, showers and bicycle parking – must be located in Nottingham city

- UK Shared Prosperity Fund (UKSPF) Business Sustainability Grant for North Lincolnshire supports businesses in reducing their energy related overheads whilst also seeking to reduce the regions CO2 emissions as a direct result. Businesses must be based within North Lincolnshire. The maximum grant per business is £5,000 and the minimum grant per business is £500.

- UK Shared Prosperity Fund (UKSPF) and Rural England Prosperity Fund Business Grants in West Lindsey is specifically intended for businesses in West Lindsey aiming to reduce their carbon footprint and improve energy efficiency. Key priorities for this scheme are (1) clean and green productivity; (2) sustainable rural growth and (3) the transition to a circular economy.

- Peak Innovation SME Innovation grant and is available for small and medium-sized businesses within the High Peak Local Authority area. This targeted support aims to help them undertake new-to-firm innovation; adopt productivity-enhancing, energy efficient and low carbon technologies and techniques; and start or grow their exports. The maximum grant per business is £10,000 and the minimum grant per business is £1,000. A larger grant may be considered in exceptional cases where grant funding is necessary for the project to proceed and deliverables are substantial.

- Staffordshire Moorlands UKSPF funding is available for the Staffordshire Moorlands Local Authority area. Visit their site for information on grants and funding opportunities available as part of the UKSPF funding awarded to the council.

- Derbyshire Dales District Council for SMEs is funded by Government, the UK Shared Prosperity Fund (UKSPF) and Rural England Prosperity Fund (REPF). It includes business advice, a business start-up programme and rural innovation grants.

Greater London

These support schemes and networks are available in Greater London:

- Better Futures+ provides up to £1,000 in free business support for London-based businesses with at least two full-time employees and turnover between £100,000 and £43M

- Greater London Fund invests in early stage companies with an average investment of £400,000 to £1M – part of the fund is set aside for companies that reduce waste

- Greater London Investment Fund offers loans from £100,000 to £1M to limited company SMEs – repayment term is 3 to 5 years and interest rates vary

- Heart of the City helps SMEs with the fundamentals of net zero, measuring carbon footprints, setting targets and disclosing progress. They have a free climate action toolkit, and in-depth course that’s free if you have less than 250 based in, or with more than 50% of your operations in the Square Mile, or you’re an SME supplier or tenant of the City of London Corporation

- Climate Essentials for Business – Climate Essentials has partnered with Westminster Council to offer free tools and support to help businesses’ reduce their carbon footprint. The programme includes access to a carbon calculator, a customised reduction strategy, 1:1 support from Climate Essentials’ expert team, and detailed reports outlining emissions and progress. This support is available for Westminster-based businesses with fewer than 250 employees, turnover less than £36m, and a total balance sheet less than £18m.

North East England

These support schemes and networks are available in North East England:

- Durham’s North East Business Support Fund gives SMEs up to £3,200 in matching funds for business improvements

- Northumberland’s North East Business Support Fund gives SMEs up to £2,800 in matching funds for business improvements

- North of Tyne Growth Fund gives SMEs up to 30% in matching funds when they plan to invest at least £67,000 in premises improvements and other capital costs. Must be located in Newcastle, North Tyneside or Northumberland.

- Tyne and Wear’s North East Business Support Fund gives SMEs up to £2,800 in matching funds for business improvements

- Newcastle, North Tyneside and Northumberland’s Business Energy Saving Team (BEST) offers free advice, energy efficiency audits and grant support to help SMEs to reduce energy use and costs

North West England

These support schemes and networks are available in North West England:

- Chamber Low Carbon gives SMEs free ‘1-2-1’ consulting to improve energy efficiency and develop low carbon products. Must be based in Lancashire.

- Cheshire West’s UKSPF Business Support Programme is funded by the UK Government through the UK Shared Prosperity Fund, supported by Cheshire West and Chester Council and 4 delivery partners. The ‘Let’s Talk Business’ programme aims to support Cheshire West and Chester businesses to increase productivity by creating the conditions for businesses to start-up, scale-up and innovate and building a stronger business base. The UKSPF Business Support Programme is a mix of support activities, 121 guidance and grants for eligible businesses.

- Cumberland Council Rural England Prosperity Funding funds capital projects for small businesses (micro and small). Beneficiaries must be located within the areas covered by the previous Allerdale, Carlisle (excluding Carlisle city) and Copeland Council areas.

- Eco-I North West offers SMEs R&D funding, capital grants and collaboration with universities to help transition to a low carbon economy – must be located in Cumbria, Lancashire, Liverpool City Region, Cheshire & Warrington or Greater Manchester

- GC Business Growth Hub provides fully funded resource efficiency support to SMEs located in Greater Manchester – includes a virtual Journey to Net Zero programme for SMEs that are at an early stage on their path to net zero emissions

- Greater Manchester Combined Authority UKSPF funding has been allocated to:

- Cost of living support for businesses: £0.5m was allocated to provide support for Greater Manchester businesses dealing with the increased cost of doing business over winter 2022-23.

- Core business support: £7.5m was allocated by UKSPF Partnership Board and GMCA in March 2023 to commission a core programme of business support for GM’s diverse business base, running from June 2022 to March 2025.

- Build a Business: £1.4m is proposed to be allocated to fund hyper-local micro-business start-up and development support, similar to that already funded via ERDF.

- Reducing inequalities: £0.5m is proposed to be allocated to fund experimental business support, enabling a test and learn approach around specific issues affecting Greater Manchester’s businesses. This programme is in the early stages and a Call for Evidence to key stakeholders is underway.

South East England

These support schemes and networks are available in South East England:

- East Sussex Council free energy audits and grants gives SMEs up to £10,000 to invest in carbon reduction – must be located in East Sussex

- Energy Efficiency Grants for East Sussex gives SMEs £200 to £1,000 in matching funds to improve energy efficiency – must be located in East Sussex, excluding Brighton and Hove

- EMphasis3 CO2 Reductions Project gives SMEs up to 36% in matching funds to improve energy efficiency and commercialise green products

- Greentech South’s Low Carbon Solent gives free business support from postgraduate students at the universities of Portsmouth and Winchester

- Climate Essentials for Basingstoke and Dean– Basingstoke and Dean council has partnered with Climate Essentials to offer local businesses, charities and social enterprises a year’s worth of one-to-one support to measure their carbon footprints, audit their operations and make realistic plans for reducing their emissions

South West England

These support schemes and networks are available in South West England:

- Clean Growth UK (South West Hub) offers SMEs funding, coaching and grant application support

- Climate Essentials for Business – Climate Essentials has partnered with Bournemouth, Christchurch and Poole Council to offer free tools and support to help 80 businesses reduce their carbon footprint for a year. The programme includes access to a carbon calculator, personalised reduction plan and 1:1 support. It is aimed at SME businesses with up to 80 employees

- Low Carbon Dorset gives SMEs with free technical advice for energy efficiency and renewable energy project ideas – must be located in the Dorset and BCP Council areas

- Low Carbon Devon gives SMEs access to research, business support, free events and fully funded internships – must be located in the Devon area

- Low Carbon Business Support (West of England Combined Authority) provide SMEs and SME charities with free expert advice and guidance as well as capital grants to take action to reduce carbon emissions and energy bills. Sign up for a free Carbon Survey and apply for a Green Business Grant of up to £15,000. Must be located in Bath & North-East Somerset, Bristol and South Gloucestershire

- Somerset Rural Prosperity Grants – applications for the next round of funding begins on 1 April 2024

- Somerset Green Business Grants are available to support Somerset micro and SME businesses – up to 250 employees – to take forward measures to reduce energy consumption and carbon emissions. The closing date for full applications is 31 October 2023.

- West of England Green Business Grant gives SMEs up to £15,000 to improve energy efficiency and install solar panels – must be located in Bath and North East Somerset, Bristol, North Somerset or South Gloucestershire

- UK Shared Prosperity Fund (UKSPF) for Bournemouth Christchurch and Poole (BCP) Council – the Economic Development team’s Investment Plan sets aside a budget of £2.5 million to support the local business economy in the following areas: start-up and growth, exporting, research and development and innovation, decarbonisation and improving the natural environment, town and district centres, development and promotion of the visitor economy

West Midlands

These support schemes and networks are available in West Midlands:

- Agri-tech Growth and Resources for Innovation (AGRI) gives SMEs free innovation support from experts at local universities – must be located in the Marches region

- Alternative Raw Materials with Low Impact (ARLI) gives free energy efficiency advice and technical support to SMEs in the Greater Birmingham and Solihull areas

- Birmingham & Solihull Industrial Symbiosis Project (BASIS) gives SMEs 12 hours of free consulting to transition waste products into useful resources for other businesses – must be located in the Greater Birmingham and Solihull areas

- Energy & Bioproducts Research Institute (EBRI) gives SMEs expert advice and research support to develop low carbon products and services

- GrowAgri gives SMEs 12 hours of expert support to adapt products for the horticulture and agriculture sectors – must be located in Worcestershire

- Low Carbon Opportunities Programme (LoCOP) – gives SMEs free energy assessments and matching grants up to £100,000 to install renewable energy systems – must be located in Worcestershire

- Low Carbon SMEs gives free energy audits and matching funds up to £12,250 for energy saving equipment or new business processes – must be located in Black Country, Greater Birmingham and Solihull

- Smarterials provides free expertise from Aston University for research and testing in material science

- Sustainability West Midlands in the regional hub for support and funding sustainable business

- West Midlands Innovation Programme provides targeted support to SMEs to access more national innovation funding

- The West Midlands Small to Medium Enterprise (SME) Grant Programme (WMGP) funding is available for:

- start-up SMEs based in the West Midlands Region (grants of £2,500 to £7,500 are available for Birmingham, Cannock Chase and Solihull based businesses only)

- existing SMEs based in the West Midlands Region (grants of £5,000 to £100,000 are available for Birmingham, Cannock Chase, Solihull, and Shropshire based businesses)

Yorkshire and Humber

These support schemes and networks are available in Yorkshire and the Humber:

- Enterprising Barnsley gives information on these approved new UK Shared Prosperity Funding (UKSPF) projects: Business Productivity and Digitisation Grant, Low Carbon Grant Project, The Launchpad Project (for SME’s that have been trading for less than three years and for micro businesses with 10 staff members or less of any age). You can also find information on the Barnsley Rural & Visitor Economy (capital) Grant Project to support those rural areas that often face specific challenges, specifically lower productivity rates.

- Green Port Hull gives SMEs a minimum of £10,000 to businesses in the low carbon and renewable sectors – must be located in Hull or the East Riding of Yorkshire

- Business support sustainability Free advice, consultancy and grant funding to help SMEs achieve net zero and prepare for the impacts of climate change. SMEs of up to 100 employees in West Yorkshire (Bradford, Calderdale, Kirklees, Leeds, Wakefield) are eligible for this support.

Learning Re-Cap

The Energy Bills Discount Scheme (EBDS) is a government initiative aimed at providing support for businesses facing rising energy costs. It replaced the Energy Bill Relief Scheme (EBRS) and offers discounted unit rates for eligible non-domestic gas and electricity consumers, with a minimum threshold in place.

Key Points:

- Eligibility: The EBDS applies to non-domestic customers who signed fixed-price contracts on or after December 1, 2021, as well as those on deemed and out-of-contract rates. However, it's essential to compare deals, as deemed and out-of-contract rates are often higher than contracted rates.

- Duration: The scheme runs for 12 months from April 1, 2023, to March 31, 2024.

- Three Parts: The EBDS consists of three components:

- Baseline discount for eligible non-domestic customers.

- Energy and Trade Intensive Industries (ETII) discount, offering higher support for certain sectors.

- Heat Network discount for heat networks with domestic end consumers.

Baseline Discount: The discount depends on how much higher your unit rates are compared to the threshold rates, and it is applied to the wholesale portion of your unit rate. If your rates are below the minimum threshold (10.7p per kWh for gas and 30.2p per kWh for electricity), you won't qualify for the discount.

Savings: Eligible businesses can expect reduced energy expenses if their contracts qualify. However, funding for EBDS is capped at £5.5 billion, significantly lower than the £18 billion allocated for EBRS. On average, the estimated discount if the business customer's tariff is above the designated threshold is a maximum of roughly 5% of the annual cost.

ETII Eligibility: Energy Trade Intensive Industries (ETII), such as mining and manufacturing, receive higher discounts. A list of eligible sectors is available on the government website.

Heat Networks: The Heat Network discount applies to entities supplying heat through heat networks, improving support for customers in line with Energy Price Guarantee (EPG) recipients. The scheme supports the wholesale element of heat networks' energy tariffs, with minimum supply prices set for electricity (£340 per MWh) and gas (£78.30 per MWh). Heat suppliers qualify if their networks meet specific criteria, and they must apply for the higher heat network EBDS rate. The application period extends until July 25, 2023. The Department for Energy Security and Net Zero (DESNZ) has developed a digital system for the application process, allowing applicants to check eligibility, apply, and submit necessary documentation.

This learning recap provides a summary of key points from the Energy Bills Discount Scheme, which is designed to help businesses navigate the challenges posed by rising energy costs in the UK.

Energy Brokers and Consultants:

Discover the advantages of working with experienced energy brokers and consultants. Learn how they can help your business optimize energy procurement and reduce costs.

Business and Commercial Energy Explained:

Get a comprehensive overview of business and commercial energy concepts, including tariffs, contracts, and essential information to avoid costly mistakes.

Energy Management Software

Explore cutting-edge energy management software solutions that enable real-time monitoring and analysis of your energy usage.

Government Schemes and Initiatives

Stay informed about government initiatives and discount schemes designed to help businesses save on energy costs.

Essential Tips and Lessons:

Access practical guidance on how to calculate your energy costs as well as tips and lessons to avoid common and costly energy management mistakes.

Webinars, Industry Insights and News:

Stay informed with our curated selection of TCD Energy webinars, articles, blogs, and news updates related to the energy industry and its impact on businesses.

Energy Efficiency:

Discover strategies to make your business more energy-efficient, reduce costs, and decrease your carbon footprint.

Sustainability Initiatives:

Explore the benefits of adopting sustainable practices and renewable energy solutions for your business. Discover case studies and success stories from companies that have embraced sustainability.

0333 335 5200

Brimstage Hall, Brimstage Road, Wirral, CH63 6JA

info@tcdenergy.com

www.tcdenergy.com

Copyright TCD Energy 2021