Business and Commercial Energy Explained

Introduction

Energy is the lifeblood of any business, powering operations and contributing to the bottom line. However, business energy in the UK operates differently from domestic energy. This webpage aims to shed light on the distinctions, business energy contract types, and the valuable 14-day cooling-off period for micro-businesses.

While both business and household energy come from the same sources, and they may even have the same supplier, there exist significant differences between the two. These differences predominantly revolve around the processes of procurement, sale, and contract structuring.

Consequently, the task of comparing and transitioning business energy isn't as straightforward as the process for household energy. This complexity underscores the rationale for enlisting the services of a business energy broker, who can expertly navigate the intricacies of business energy.

How do business energy contracts differ from domestic energy contracts?

The procurement and sale process of business energy introduce a layer of complexity, resulting in distinctive rules for switching. Here, we outline the principal differences between business and domestic energy contracts:

Rates and Charges (including VAT):

Most businesses have greater energy demands than households and exhibit varying consumption patterns throughout the day. As a response to these variances, suppliers establish distinct pricing structures that account for volume and usage patterns. Businesses also encounter unique charges on their energy bills, including the Renewable Obligation (RO), Smart Export Guarantee (formerly the Feed-in Tariff), and the Climate Change Levy (CCL). Notably, the standard rate of VAT on business energy stands at 20%, whereas it's 5% for domestic energy. However, a 5% rate is accessible for specific business categories, charities, care and residential homes, houses of multiple occupation, purpose built student accommodation to name but a few. If you are uncertain if your business qualifies for a reduced rate of VAT, please contact us and we can advise.

Contract Length:

While domestic energy contracts typically span 12 months, businesses have the flexibility to secure rates for durations extending up to three or four years. Most suppliers will agree contracts with a minimum term of 12 months. Enlisting the expertise of a professional energy broker can provide valuable insights into the market conditions which will determine the likelihood and energy costs increasing or decreasing during the chosen contract term.

Unscrupulous and unprofessional energy brokers may try to encourage businesses to lock into longer contracts than they need. It's imperative that when selecting contract durations, businesses not only consider practical considerations such as their short, mid-term and long-term plans, but also what the energy market predictions indicate.

Rushing into signing or 3 or 4 year contract without careful consideration can impact a businesses bottom line, especially in circumstances where costs for energy may reduce during the contract term ultimately resulting in businesses paying more for their energy than is necessary.

Cooling-Off Period:

A significant variance emerges in the realm of cooling-off periods. Household energy contracts grant a 14-day cooling-off period, permitting customers to cancel their contracts within this window without incurring penalties. In stark contrast, business energy contracts do not provide such a safeguard.

Once signed, businesses are contractually bound. Hence, seeking guidance from a broker is essential to ensure alignment between the contract and the unique needs of the business.

Price Caps:

Domestic energy rates have been subject to a price cap since 2019, aimed at alleviating the impact of escalating energy costs for households. In contrast, commercial energy contracts lack this protective measure. Due to this lack of protection for business customers, the government offers discounts on eligible commercial energy contracts through the Energy Bills Discount Scheme. The scheme consists of a number of components and can be confusing for businesses to get to grips with and therefore many businesses have not taken full advantage. In addition, in many cases, energy suppliers should automatically add discounts to business customer's energy bills. It's not at all uncommon for businesses to be over-charged by suppliers due to not allocating government subsidised discounts, so it's important for businesses to arm themselves with a basic understanding of the scheme. Please visit our page for more information on Government Discount Schemes and how to determine if your business is eligible.

Dual Fuel:

Households often benefit from discounts when obtaining both gas and electricity from the same supplier under dual fuel arrangements. Businesses, on the other hand, are required to procure separate contracts for gas and electricity, even when both services originate from the same supplier. This can offer opportunities to find the cheapest suppliers for electricity and gas, as more often than not, the cheapest supplier for electricity will not be able to offer the cheapest tariffs for gas (and vice versa). The key here is that engaging the whole market to identify the cheapest available tariffs for both gas and electricity often pays dividends and results in lower annual costs overall for electricity and gas. This can be a time-consuming and laborious process for businesses and using the services of a professional energy broker does certainly save businesses time and energy as well as ensuring that no stone is left unturned to identify the lowest cost options available to businesses.

Objections:

Domestic energy customers generally encounter contract refusal when they owe more than £500 for gas or electricity to their existing supplier. In contrast, suppliers can decline a commercial switch if the business has outstanding debts, holds an active fixed-term contract with more than 9 months to run, or if the current contract stipulates any other reasonable prerequisites. Energy suppliers also require customers to meet credit scoring pre-requisites, regardless of if the customer is domestic or a business however there are some important points to be aware of.

Generally, when a business is applying for a new energy contract, or switching from one supplier to another, their business credit score will be checked. The majority of suppliers require businesses to meet the minimum requirement of having a credit score of 35 out of 100. The Big Six energy suppliers utilise Credit Safe or Experian Business to asses the credit worthiness of businesses applying for supply contracts. Visit Experian Business to access your business credit score. Taking some time to ensure that your business credit score is accurate and addressing any errors or inaccuracies can result in improved credit scoring, saving the business money by enabling access to the most competitive tariffs.

For businesses who do not meet minimum credit score requirements, all is not lost, however having a low business credit score can result in unfavourable terms and punitive tariffs being offered. For example, many commercial/business energy suppliers will request a deposit before a agreeing a new contract with a business. who does not meet minimum credit score requirements. The deposit amount required is determined by the supplier, and there are no rules or regulations to determine the maximum amount a supplier can request. Generally, the deposit required will reflect 10 to 20 percent of the total annual contract cost (determined by estimated annual consumption).

So why are business and domestic energy different?

In the residential sphere, energy usage is relatively uniform, primarily entailing gas for heating and cooking, as well as electricity for lighting and household appliances. While consumption levels may vary among households, suppliers can readily offer standardised tariffs applicable to most, ensuring that everyone pays the same rates.

Conversely, the business landscape is marked by significant variation. At first glance, businesses such as restaurants and salons may seem similar in terms of their commercial setup, employee count, turnover, and financial health. However, they utilise gas and electricity in distinct ways, often with varying usage and different times throughout the day. These distinctions, alongside geographical location, play crucial roles in determining the rates businesses are charged.

Furthermore, suppliers must consider the inherent risk associated with business contracts. Businesses typically consume far more energy than households, and suppliers must purchase the totality of the necessary energy supply well in advance. If a business unexpectedly closes its doors during a multi-year contract, suppliers may face substantial financial losses, potentially equivalent to multiple years of payments. This elevated risk profile contributes to increased costs for suppliers, which, in turn, influences the rates offered. Additionally, a business's creditworthiness is scrutinised when determining energy rates, as it is indicative of the potential financial risk posed to the supplier.

These complexities make it unfeasible for suppliers to provide standardised commercial energy tariffs. Instead, each contract is meticulously tailored to the specific needs of the individual business. Consequently, even those experienced in switching residential energy providers may find it beneficial to seek expert assistance when navigating the complexities of business energy contracts.

What does "Energy Procurement" Mean?

Energy procurement is the streamlined process of exploring and identifying the most suitable and cost-effective business energy contracts available in the market for a business, ensuring a seamless transition of energy supply for your business operations. This strategic endeavour entails a comprehensive evaluation of your gas and electricity consumption, leading to the collaboration with energy suppliers in order to pinpoint the ideal contract aligning with your business's unique requirements. Energy procurement also delves into diverse supplier options, sustainability objectives, and the integration of renewable energy sources.

The core objective of energy procurement is to guarantee that your business secures the most suitable and cost-effective energy arrangements. Whether your organisation employs an in-house energy procurement specialist or seeks assistance from an energy broker, the fundamental process remains consistent.

In essence, energy procurement serves as the vital bridge between your business's energy needs and the multitude of contract options in the market, ensuring that you acquire the right energy deal to propel your operations forward.

For instance, take the case of a small B&B. its energy requirements differ significantly from those of a large hotel. The B&B business primarily involves assessing the annual energy consumption of then property, including electricity and gas. Electricity and gas consumption (more often for heating and running the kitchen) is typically minimal, making the energy procurement process straightforward. B&B and other types of small business owners may even undertake the energy procurement process independently without the guidance of an energy broker.

In contrast, large hotels entail more intricate energy needs. To navigate this complexity effectively, it is advisable to engage an energy broker who will bring expertise to the table, ensuring the business selects the most suitable and cost-effective tariffs for the hotel's specific consumption patterns. If your energy consumption experiences fluctuations over the year, these professionals guide you on the optimal timing for securing a new energy contract. By breaking down your options, energy brokers illuminate the options that offer the greatest financial advantages for your business.

What are the benefits to businesses who use a thorough energy procurement process?

Mitigating Hidden Costs:

A thorough energy procurement significantly reduces the risk of falling victim to undisclosed fees often associated with less reputable providers and brokers, shielding your business from unexpected financial burdens.

Reliable Supplier Selection:

Prioritising detailed research ensures that your chosen supplier is not only cost-effective but also offers solid customer support and financially stable, offering peace of mind to business owners who can depend on a consistent energy source. As a result of the energy crisis, during 2021, 28 energy companies went bust, impacting more than 4.2 million customers. with nearly 2 million of those customers being businesses.

Enhanced Financial Forecasting:

Through the energy procurement process, your dedicated broker should maintain a comprehensive record of your usage patterns. This data empowers you to more accurately forecast your energy budget and make informed decisions for the upcoming financial year.

Renewal Management:

Your broker keeps your contract details on hand, serving as a vigilant custodian of your energy arrangements. They not only keep you apprised of any alterations with your supplier but also provide timely reminders for contract renewals. It's of utmost importance to steer clear of out-of-contract rates, which are typically 30%-40% higher than fixed rates . Ensuring that your contract doesn't lapse without negotiation for a new term is essential. Once your existing contract concludes, very high 'Out of Contract' rates kick in until a new contract term is established.

Managing multiple contracts with differing end dates can be challenging and might lead to inadvertent lapses. It's an energy broker's responsibility to keep you informed about impending renewals, present all requisite information for your decision-making process, and highlight the most favourable new terms and options available to your business.

Optimised Savings:

Collaborating with energy experts, be they energy brokers or consultants, during the energy procurement journey often leads to substantial long-term savings. Their market insights enable them to recommend the most advantageous deals, maximising your cost-efficiency in the long run.

Obtaining and Comparing Business Energy Quotes:

Unlike the simplicity of comparing domestic energy options via price comparison websites, business energy demands a more tailored approach. Each business possesses unique requirements, and factors like energy consumption, geographical location, and business size are integral in determining applicable rates.

To secure the most advantageous rates for your business, you'd traditionally need to engage in the laborious process of contacting multiple suppliers and obtaining individual quotes. If your business utilises both gas and electricity, the process multiplies.

However, by using services such as the one we offer at TCD Energy, you can streamline this process and save buckets of time, leaving you to focus on building your business. We leverage the information you provide to obtain and compare quotes from our panel of suppliers. Subsequently, we guide you through the available options, ensuring that you select the contract and supplier that align most closely with your business's distinctive needs and of course, is the cheapest possible tariff available for your business.

Understanding Energy Tariffs

Comparing energy tariffs for your business can be a complex task. The multitude of suppliers, each offering different rates and deals, can make it challenging to find the best option for your small business. So, before diving into the process of selecting a new energy tariff, it's crucial to know when your current one is ending and how to secure the next cost-effective deal.

What is an energy tariff?

An energy tariff is the pricing structure used by your energy provider to bill you for gas and electricity, whether for your home or business. The type of tariff you are on dictates the rates you pay, including additional fees like standing charges and VAT.

Whether you're a newly established small company or a well-established enterprise, it's wise to regularly explore and compare energy providers when your existing tariff nears its renewal date. By comparing energy deals, you can ensure that you're on the most suitable tariff for your specific needs and avoid overpaying by being aware of the options available.

Even if you agree to a gas and electricity deal with the same supplier you originally had, you’ll still get two separate contracts. This is because business energy suppliers don’t offer dual-fuel deals for businesses.

What are the different types of energy tariffs?

With numerous suppliers offering various tariffs and price structures, selecting the best fit for your business can be confusing. In contrast to home energy, commercial energy offers distinct options based on your business's size and energy usage patterns. Here's a brief breakdown of the various types of business energy deals and their key advantages and disadvantages to aid your decision-making:

Before we get into the types of tariffs, lets just elaborate on the two main components that make up an energy tariff.

Standing charge

This is the daily fixed cost included in your bill and it’ll usually cover the maintenance of your meter.

Unit rate

This is the price that you pay per kilowatt-hour (kWh) for any energy that your business uses. You’ll want this figure to be as low as possible when you’re searching for deals.

Although there are a number of other costs included in the amount you're billed for, these are the two that will change depending upon your supplier and the type of energy contract you're on.

Fixed-rate Tariffs Explained:

Fixed-rate tariffs maintain a constant price per unit of kWh for the gas and electricity you consume during your contract. At TCD Energy, we work with a panel of trusted business energy suppliers that offer fixed-rate energy deals of between one and five years, depending upon your circumstances.

Fixed-rate tariffs are great for businesses looking for an affordable and hassle-free option but don’t be fooled by the name, the cost of your tariff still might change.

Pros: Fixed-rate tariffs are typically the cheapest option and can make budgeting for your business easier. They're also the only way to protect against future energy price rises.

Cons: If energy prices fall, you could be paying more than the current market rate for your energy until your contract expires. Automatic rollover at the end of your contract means you'll pay more expensive out of contract rates, but you can solve this issue by signing up for a new deal before your current one ends.

Variable-rate Tariffs Explained:

Variable-rate contracts fluctuate with market prices, meaning you pay more when prices rise and less when they fall.. If you’re willing to take the risk, you can just as easily reap the benefits if market prices fall.

Pros: You could pay less for your energy if market prices drop. You can switch plans whenever you want.

Cons: Prices generally tend to rise over time so your bills might increase even if you're using the same amount of energy. You’ll also have to constantly follow market prices to predict how much you’ll pay.

Deemed Rate Tariffs Explained:

If you let your current tariff end without arranging a new deal or switching to a new supplier, you’ll be placed on a deemed-rate tariff. Also known as out of contract rates, these are generally among a supplier's highest prices. If you find yourself rolled onto this type of plan, you can switch whenever you want.

Pros: You’ll still be covered on a plan if you forget to arrange a new deal or switch. You can switch to a different deal at any time.

Cons: The prices will be expensive so it’s advisable that you switch as soon as possible.

Online Tariffs Explained::

Online energy tariffs are those which need you to access and manage your account via the internet. You’ll be asked to send the meter readings to your supplier, and you’ll receive bills online via your account or email. You might also get a discount on your gas and electricity bill when you sign up to an online tariff.

This means you won't get any paper bills through the post and will need to resolve any issues online (although a telephone number for energy supplier complaints should also be available).

Pros: If you prefer to manage all of your bills and documents via the internet, this could be a good plan for your business. The discounted rates might also come in handy.

Cons: As all correspondence is managed online, you could overlook important information if your inbox is cluttered. Though you should be able to regularly check your account details on your supplier's website. If you prefer to have paper bills, then an online tariff may not be for you.

It's important to note that an Online Tariff is not actually a tariff! This describes the means by which you manage your account and associated billing, however its important to note that you should also be very clear about the type on online tariff you may be signing up to, For example. an online tariff be fixed, variable or deemed. You still need to select the type of online tariff that meets your businesses requirements.

Time of Use Tariffs Explained:

Time of use tariffs — or “off-peak” tariffs as they’re sometimes known — charge less for energy usage through the night as people aren't using as much electricity. These types of tariffs only apply to electricity.

Economy 7 and Economy 10 are the two main types of time of use tariff. These tariffs come with a smart meter that monitors how much energy you use during the day and night and gives you a price based on your consumption.

Economy 7

Economy 7 tariffs provide you with off-peak rates for seven hours of the night. You get charged more for any energy you use in the remaining 17 hours of the day.

Economy 10

Economy 10 tariffs give you off-peak electricity for 10 hours. The extra three hours will usually fall during quieter periods of the day. Depending on the supplier, Economy 10 runs in three separate intervals — an off-peak low rate in the afternoon, four hours in the evening, and three hours in the early morning.

Feed-In Tariffs Explained:

The Feed-In Tariff, introduced on April 1, 2010, and closed to new applicants by the end of March 2019, was a widely embraced government program. By its 11th year, it had amassed 869,976 active installations, with a staggering 96% being solar panels or PV systems, showcasing its popularity. While it's no longer an active scheme, numerous businesses still continue to reap its benefits.

But what exactly is this scheme, and how did it assist businesses in generating extra income?

In a nutshell: The Feed-In Tariff was established to combat global warming and promote renewable energy adoption. It allowed both domestic and business energy customers to sell any surplus renewable energy they generated back to the National Grid.

Eligibility for this tariff hinged on the type of renewable energy system installed and its compliance with specific installation and output criteria.

Export rates for renewable energy varied depending on the type of system in place and were adjusted to keep pace with inflation. Benefits included reduced energy expenses and earnings based on the chosen generation tariff.

The Feed-In Tariff ceased to accept new applications in 2019, giving way to the Smart Export Guarantee. Although a similar scheme, it lacks a generation tariff, yet eligible businesses can still apply for it.

The Smart Export Guarantee (SEG), introduced on January 1, 2020, took the place of the FIT scheme. Under the SEG scheme, energy suppliers, now referred to as SEG licensees, compensate small-scale generators of low-carbon electricity, known as SEG generators, for the surplus energy they export to the National Grid. This scheme closely mirrors the FIT scheme but lacks a generation tariff.

Similar to the FIT scheme, the SEG scheme's objective is to incentivise both residential and commercial customers to produce environmentally-friendly energy. The same types of technologies are eligible as in the FIT scheme and must adhere to specific criteria, including a capacity of 5 Megawatts or 50 Kilowatts for micro combined heat and power systems. All energy suppliers with over 150,000 customers are mandated to provide this tariff, while smaller suppliers have the option to participate voluntarily.

For a comprehensive list of SEG licensees, you can refer to the

Ofgem website.

Here's How You Find The Energy Tariff Expiry Date

Knowing your energy tariff's end date is crucial to avoid overpayments when your contract rolls over. This is also often referred to as the "Contract End-Date".

While domestic energy suppliers must notify you when your tariff has 49 to 42 days left, the rules differ for business energy contracts.

Here's how to find your tariff's expiry date:

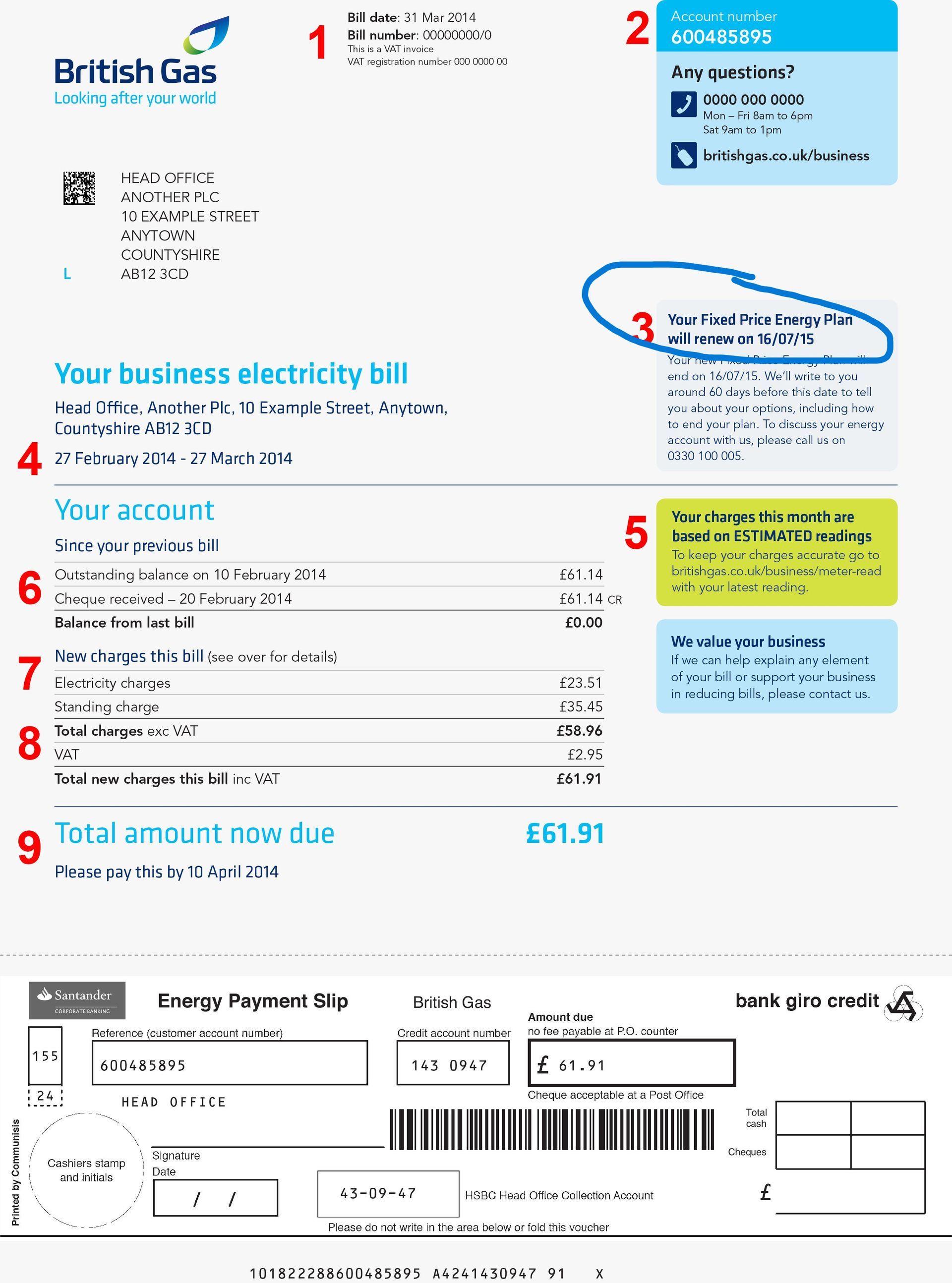

Check Your Latest Bill: Look for the end date of your tariff displayed alongside other essential information on your latest energy bill.

Review Your Switching Letter: Energy suppliers typically send a switching letter up to seven weeks before your contract's end, either by mail or electronically.

Contact Your Energy Supplier: Reach out to your supplier directly if you can't find the end date. Ensure you have your account name and number handy when contacting them.

Use a Professional Energy Broker: Many high-quality energy brokers will have access to industry data, meaning can often provide you with quicker access to the information you need, such as' tariff/contract end-dates, annual consumption, the details of the tariff you currently have in place (fixed, variable, deemed etc.)

What Happens at the End of a Fixed-Rate Energy Tariff?

The outcome really depends on whether you've arranged a new energy deal:

If you've already signed a new energy contract, you'll transition to your new deal on the designated date. This is usually the day after your existing tariff ends.

If you haven't signed a new contract, you'll be placed on your supplier's more expensive out-of-contract rates the day after your current tariff ends. In this case, it's advisable to compare business energy deals and switch to a more favourable option before you incur additional costs due to the punitive rates a deemed-tariff applies to your energy account. Deemed tariffs are generally much more expensive, so it's important not to delay in switching to a new tariff and/or supplier.

Selecting the Best Energy Tariff for Your Business

When comparing energy tariffs, focus on two primary costs from your latest bill:

Standing Charge: This is the fixed daily cost covering meter maintenance.

Unit Rate: The price per kilowatt-hour (kWh) of energy consumed. A lower unit rate is preferable when seeking cost-effective deals.

While there are other costs in your bill, these two elements vary based on your supplier and contract type. Keep in mind that business energy deals do not typically offer dual-fuel options.

Supplier or Tariff Switching Timelines and Considerations

Business energy switches take between three and six weeks but won't occur until your current contract concludes. The switching duration depends on your switching window and contract sign-up date. Ensure you're satisfied with the contract length, notice period, unit rates, and standing charges before committing is imperative.

Switching Before the Tariff's End Date

Once you've committed to a business energy deal, you must wait until your current tariff/contract expires to switch to a new one. However, you can begin comparing deals as soon as your switching window opens. Switching windows generally open between 6-9 months prior to your tariff/contract end-date, meaning you can take advantage of market conditions and secure beneficial tariffs well in advance of your current tariff/contract ending.

Also, if you previously secured a favourable fixed-rate deal, this early switch helps avoid costly out-of-contract rates by inadvertently leaving it too late to arrange a new tariff and for the switch to complete, before your current tariff/contract ends.

Energy Brokers and Consultants:

Discover the advantages of working with experienced energy brokers and consultants. Learn how they can help your business optimize energy procurement and reduce costs.

Business and Commercial Energy Explained:

Get a comprehensive overview of business and commercial energy concepts, including tariffs, contracts, and essential information to avoid costly mistakes.

Energy Management Software

Explore cutting-edge energy management software solutions that enable real-time monitoring and analysis of your energy usage.

Government Schemes and Initiatives

Stay informed about government initiatives and discount schemes designed to help businesses save on energy costs.

Essential Tips and Lessons:

Access practical guidance on how to calculate your energy costs as well as tips and lessons to avoid common and costly energy management mistakes.

Webinars, Industry Insights and News:

Stay informed with our curated selection of TCD Energy webinars, articles, blogs, and news updates related to the energy industry and its impact on businesses.

Energy Efficiency:

Discover strategies to make your business more energy-efficient, reduce costs, and decrease your carbon footprint.

Sustainability Initiatives:

Explore the benefits of adopting sustainable practices and renewable energy solutions for your business. Discover case studies and success stories from companies that have embraced sustainability.

0333 335 5200

Brimstage Hall, Brimstage Road, Wirral, CH63 6JA

info@tcdenergy.com

www.tcdenergy.com

Copyright TCD Energy 2021